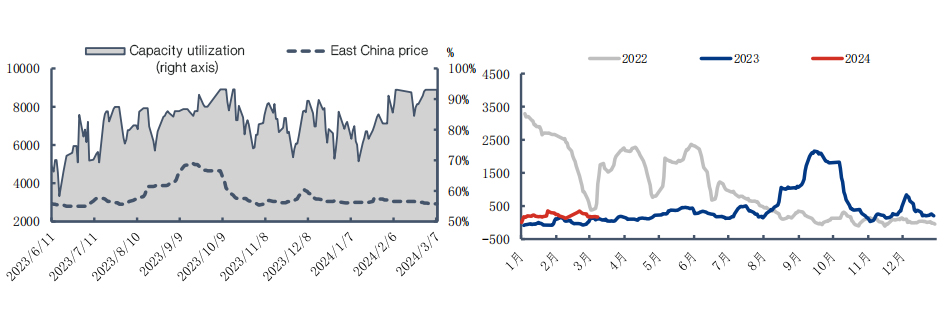

The market price of glacial acetic acid was partially weak this week. Last weekend, as the main factories in Shandong lowered their prices, the main reason was that the supply of goods from other regions impacted the market. At the beginning of the week, the starting prices of the northwest factories fell, and the overall market sentiment for purchasing goods was acceptable. Enterprise inventories are expected to fall. As the downstream gradually recovers, the market is gradually replenishing goods. However, after the initial need for replenishment, the overall market trading atmosphere is mediocre. At present, the supply and demand of the glacial acetic acid market are both high, causing a dilemma. In some areas, factory costs are close to the cost line, and there is a strong willingness to raise prices.

Recently, as logistics and transportation in various regions have returned to normal, the shipping sentiment of various companies has improved. In addition, the downstream is slowly recovering after the Lantern Festival, and there is a periodic demand for replenishment. Most factories are showing a trend of reducing inventory. At present, the overall capacity utilization rate of factories is high, but due to expected improvement in downstream demand, it is expected that corporate inventories may continue to decline in the short term.

Ethyl acetate

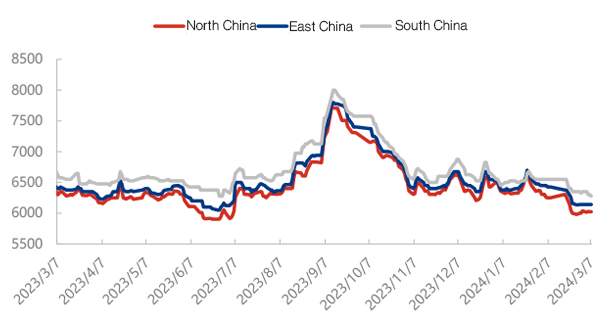

There are regional differences in the ethyl acetate market this week, and pressure on prices continues to exist. Although the transactions of mainstream factories continued to increase during the week, there was no substantial driving force in the market, and domestic terminal consumption was slow in terms of demand. The weakening external prices have led to cold export negotiations, and the market prices of raw materials acetic acid and ethanol have been weak. The cost side has obviously restrained the market mentality, thus restricting sellers’ price adjustments. Prices in East China are mostly stable and wait-and-see. The focus of transactions in South China continues to weaken, and new production capacity is released in surrounding areas. Against the background of high supply, high inventory, and cautious market demand, the absolute price along the coast is low, and the inter-regional arbitrage window is closed, which continues to put pressure on the mainland market.

Looking at next week, short-term domestic sales and export orders are still in the recovery stage, while upstream supply continues to be abundant, and there is little expectation that the gap between market supply and demand will be restored. There is currently no good news to be found. Manufacturers may adjust prices based on shipments, and the mainstream market maintains a narrow range of consolidation.

Butyl acetate

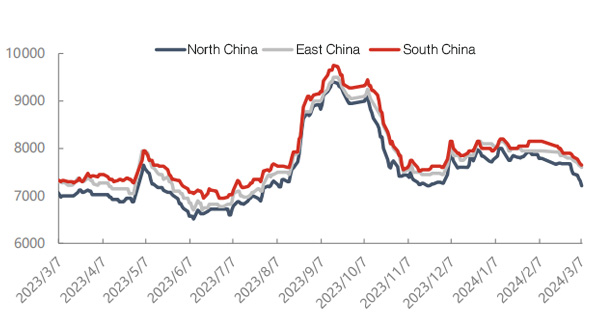

At the beginning of the week, the price of raw material n-butanol was running weakly, the cost side suppressed the market mentality, and the supply of goods in East China and South China increased, but the follow-up speed of terminal demand was relatively slow. Some downstream users are still resuming work, the contradiction between supply and demand is acute, market procurement is not yet active, and there is certain pressure on upstream shipments. Afterwards, the price of n-butanol, the raw material, fell sharply. Based on the negative logic of cost, market procurement was deserted. Most industry players were bearish on the market outlook and gradually delisted the product to consume inventory. As well as low terminal construction, demand and costs have suppressed market sentiment, and it is difficult to see large-volume transactions.

Looking at next week, price fluctuations on the raw material side will continue to suppress the market transaction atmosphere. Currently, butyl acetate factories have a certain demand for shipments, and downstream purchases may be low. Low-price units are moving smoothly and inventory is declining. It is expected that the butyl acetate market price will continue to be weak next week, and we will continue to pay attention to the follow-up demand for domestic sales and export orders.

Post time: Mar-11-2024