Glacial acetic acid

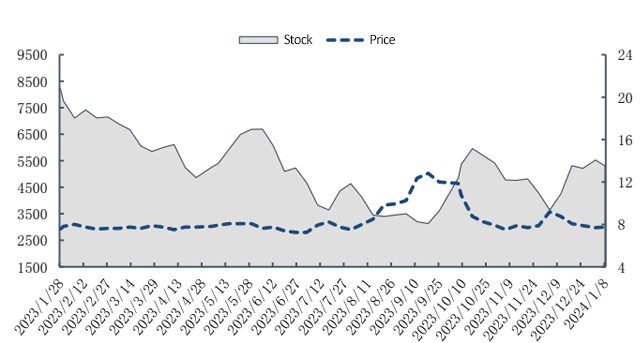

The domestic acetic acid market price is relatively stable this week. The downstream profits of glacial acetic acid have been restored this week. The price of glacial acetic acid has increased due to smooth factory shipments, a fair market trading atmosphere, and downstream stocking. However, the price fluctuation of methanol at the cost end is limited, so the profit of glacial acetic acid has increased simultaneously.

The price of glacial acetic acid has gradually increased slightly since the weekend. As factory shipments improve, corporate inventories have declined. Traders and downstream companies continue to replenish goods on demand, and some downstream companies are preparing for the Spring Festival.

Supply, this week, due to frequent unexpected failures in the factory, the overall capacity utilization rate has dropped, and the new downstream vinyl acetate device has been put into operation as scheduled. The demand for glacial acetic acid has increased. However, as the Spring Festival approaches, subsequent transportation vehicles have gradually decreased. Freight costs may rise, and factories are still focusing on keeping inventory low. However, as supply gradually recovers, we need to pay attention to subsequent downstream demand.

In this period, glacial acetic acid stocks have declined in all regions except North China. As the price dropped to the previous low level, some companies began to take goods, and downstream companies were in urgent need of replenishment. Especially in the northern region, shipment sentiment improved, factory prices tentatively increased slightly, and the trading atmosphere in other regional markets gradually improved. Therefore, The inventory of various enterprises has declined slightly. It is expected that the inventory of enterprises may not change much in the short term.

Ethyl acetate

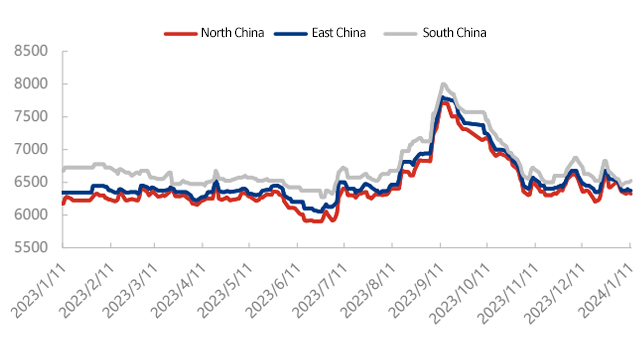

The market price of ethyl acetate stabilized after falling this week.

At the beginning of the week, the market price of ethyl acetate continued to fall, and the market transaction volume was flat. Most of the surrounding factories were subject to their own shipment needs, so they gave priority to goods. Some businesses had bargain hunting needs, and the market price of raw material acetic acid continued to fluctuate in some parts. The buying sentiment at the low level of the market is further stimulated. The overall buying momentum of the market is stable, and most factories are shipping smoothly. However, due to the difficulty of substantive improvement in the market and the low inventory operation of factories, the price increase following the raw materials is extremely limited. Upstream operations are more cautious and consolidation is out. Mainly goods. In the later period, the market went through a round of concentrated replenishment and the market price of raw ethanol continued to weaken. The cost side’s support for the market weakened, and the market buying momentum weakened.

After this week’s concentrated downstream purchasing, social inventories have increased. Next week, inventory may be delisted one after another, and the atmosphere shows signs of weakening. In terms of costs, the raw material acetic acid market may weaken, and ethanol prices continue to weaken. There are certain constraints on the market, and it is expected that the focus of the ethyl acetate market will shift downward next week.

Butyl acetate

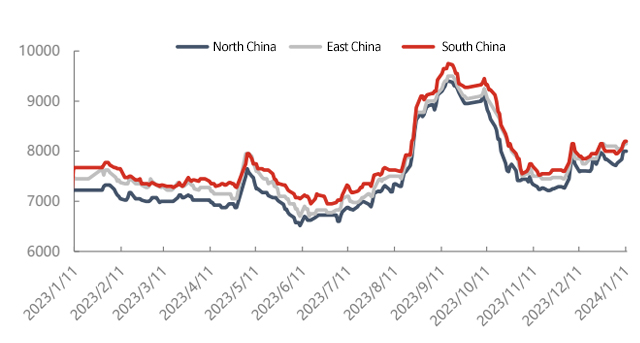

This week, the butyl acetate market is partially focused on rising prices.

At the beginning of the week, the market price of butyl acetate consolidated within a narrow range. The market prices of raw materials acetic acid and n-butanol both showed an upward trend. Although the cost side provided strong support for the bottom price of the market, it was difficult for industry players to increase their purchasing enthusiasm due to the slow consumption of terminals. Vibration, small orders are maintained, and factory shipments have not improved significantly. In the later period, the raw material n-butanol market has supported a wide range of price increases based on the logic of reducing its own supply side. The bidding of individual factories has increased by nearly 400 yuan/ton. The cost side has given obvious support to the market. Traders and downstream companies are in a chasing mood and have obvious buying intentions. Strengthening, but production and sales are still unbalanced. It is difficult to follow the market growth compared with raw materials. After a period of replenishment, the purchasing pace gradually slows down. Upstream prices are arranged within a narrow range while giving priority to ensuring low inventory.

Looking next week, the market supply will remain abundant, but downstream demand will gradually weaken, and the fundamentals will be relatively weak. As a cost side that supports absolute prices, it is expected to continue to support market sentiment, but most industry players are in a wait-and-see state regarding price fluctuations. Longzhong predicts that the market price of butyl acetate may fluctuate in a range next week, and high-price transaction prices will loosen.

Post time: Jan-12-2024