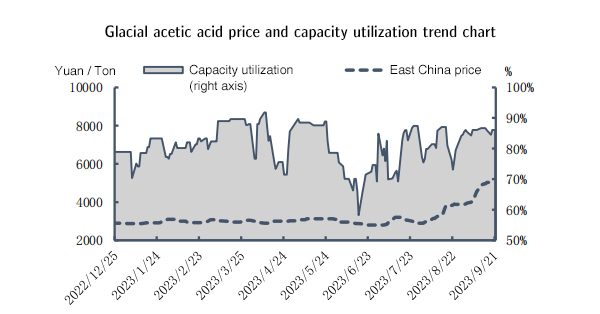

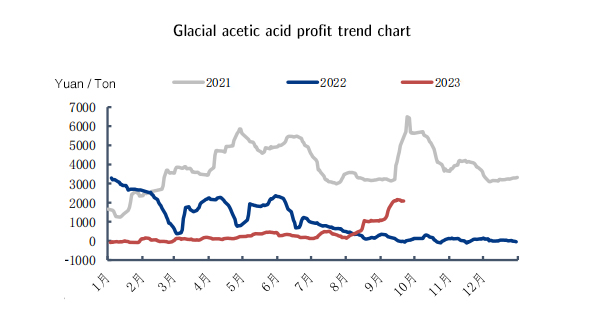

Glacial acetic acid situation

The glacial acetic acid market fluctuated at a high level this week, and trading sentiment dropped. The inventories of factories and enterprises still remain at the lowest level, and factory supplies are mostly pre-sold, so there is no sales pressure for the time being. During this week, factories have a strong willingness to raise prices. Near the middle of the month, factory prices continue to push up, but there is a strong willingness to ship intermediate goods. The overall quotation has moved downwards. Downstreams are slightly resistant to high prices. Large downstreams are mostly executing long-term contracts and stocking up. After completion, small downstream companies have stopped or reduced their loads. High costs have resulted in severe downstream profit losses. Downstream companies mainly replenish goods on demand and are not willing to stock up on goods. At present, the long-term contract is about to end, the factory has a strong willingness to raise prices, and there are not many low-priced goods in the market. Pay attention to the downstream willingness to purchase goods in the future.

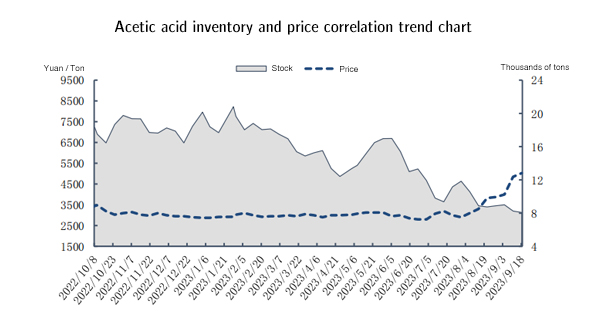

Acetic acid inventory analysis

As of September 18, the inventory of domestic acetic acid companies this week was approximately 80,800 tons, a month-on-month increase of 2.08%. In this period, glacial acetic acid stocks continue to decline, but the extent is limited. Recently, the price of glacial acetic acid has risen rapidly, and the retail volume of factories is small. The main buyers are long-term traders, especially in East China, Central China, Shandong, Hebei and other regions. In the northwest region, as traders have recently increased their sales, some small downstream buyers have lowered their purchasing sentiment. As a result, shipments have slowed down and inventories have increased slightly, but they are still at low levels. Longzhong Information predicts that inventories may fluctuate slightly in the short term.

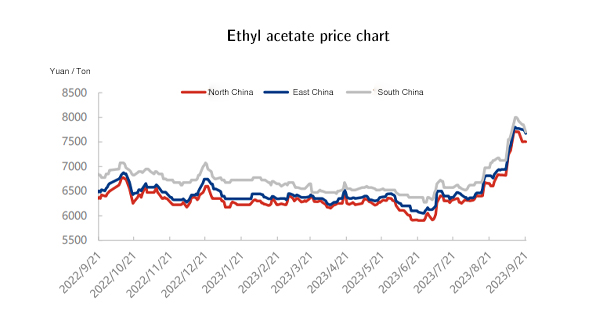

Ethyl acetate situation

The ethyl acetate market was overall weak this week, and transactions in various places were not ideal. The East China market increased by 0.32 percentage points during the week compared with last week. Although the price was briefly stable at the beginning of the week, the market lacked real momentum. The main manufacturers quickly corrected after poor shipments for many consecutive days. However, the transaction did not meet market expectations. As the factory inventory pressure increased, profits were once again lost due to the demand for inventory discharge. However, the terminal stocking intensity is mediocre, and the current price perception is relatively high, which has caused the industry to be temporarily inactive in purchasing. Except for certain rigid needs, it is unable to generate incremental purchase demand and some arbitrage shipment intentions. Therefore, although the price is expected to stop falling, Hard to see a rebound. Some factories, considering that the market price of raw material acetic acid is still on the strong side, are unwilling to offer a wide range of price drops under cost pressure and their own inventories are under control. As regional price differences widen, the arbitrage window opens between East China and Shandong, and the Asian Games affects transportation to Zhejiang, some terminal manufacturers have a demand for advance stocking, low-end buying intentions are positive, factory transactions have increased, and prices remain stable. run.

Looking at next week, with the Double Festival approaching and the opening of the Zhejiang Asian Games, some transport capacity is expected to decline, but downstream inventory replenishment is expected, but the overall replenishment intensity remains to be seen. At the same time, the upstream inventory is also being processed at the same time, and the upstream and downstream mentality continues to compete. , and the market price of raw material acetic acid may have room to weaken, and cost support is loose. Longzhong predicts that the ethyl acetate market may weaken next week.

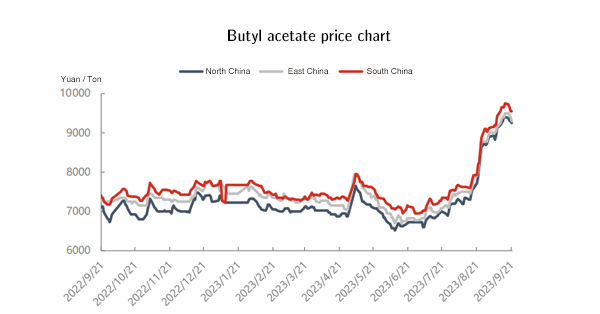

Butyl acetate situation

The market price of butyl acetate rose first and then fell this week. The East China market increased by 1.29 percentage points during the week compared with last week. At the beginning of the week, the prices of raw materials acetic acid and n-butanol continued to rise. The cost side provided strong support to the market. Upstream factories had strong willingness to push up prices. Holders steadily and tentatively advanced their offers. However, terminal companies were not very interested in buying in the market and kept low-end stocks. The mood of bidding has led to sluggish supply on the supply side, and the buying interest on the market has continued to be weak, making it difficult to increase trading volume. In the later period, the market price of n-butanol, the raw material, fell sharply. The weak cost side restrained the mentality of downstream companies entering the market. Manufacturers lowered prices to receive new orders. However, due to low market supply, factories were not willing to make substantial profits. Most downstream users were waiting and watching, with obvious willingness to wait for the decline. New Order transactions are limited, and some arbitrage orders are acceptable for shipment.

From the current point of view, the overall start-up of domestic butyl acetate is low, and the supply side will support the market sentiment. However, the impact of the holidays is gradually taking over. In order to ensure a smooth holiday, upstream and downstream players have different gaming mentality, and the raw material n-butanol has limited room for another downward trend. It is expected that the butyl acetate market price range will fluctuate in a stalemate next week.

Post time: Sep-22-2023