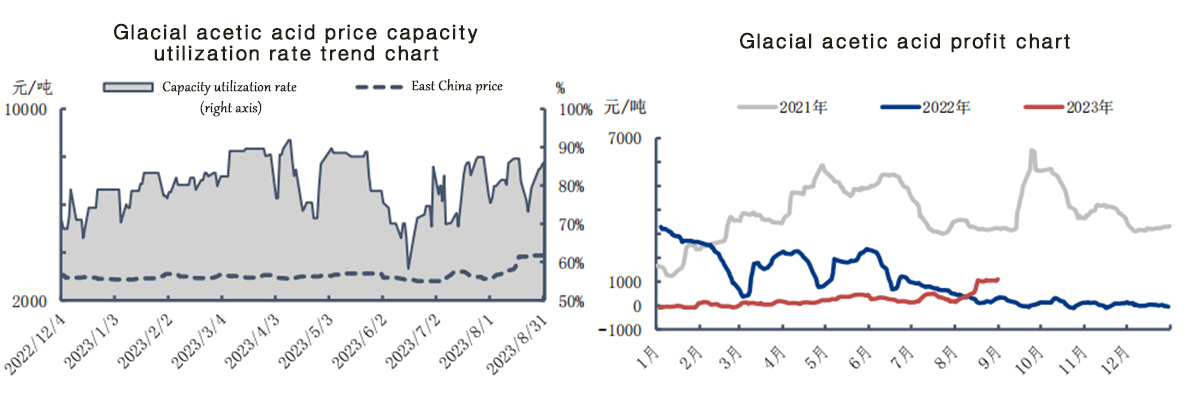

Glacial acetic acid

Last week, the glacial acetic acid market continued to push up, and the low factory inventory was the main factor supporting the price rise. In terms of device dynamics, the Nanjing INEOS plant has restarted. Currently, Guangxi Huayi and Jiangsu Thorpe plants have resumed normal operation. During the maintenance of Anhui Huayi, the overall supply has increased significantly; Long-term contract traders mostly quote according to the current market conditions, mainly execute long-term contracts, and replenish goods on demand in the downstream. However, as the price of glacial acetic acid fluctuates at a high level, the overall market turnover is mixed, and the South and Northwest regions are slightly weak. The tight supply of regional goods in the early stage has eased, but the price is still running at a high level.

Although the inventory of glacial acetic acid increased slightly in this period, the inventory of factories still remained at a low level. Recently, factories mostly execute long-term contracts and pre-contracts, and the overall shipments are acceptable. However, with the gradual recovery of various devices, the enthusiasm for purchasing goods in the Northwest and North China regions has weakened, and the overall inventory has increased slightly. The overall inventory in other regions may be control. It is expected that there may be a slight increase in inventory in the short term.

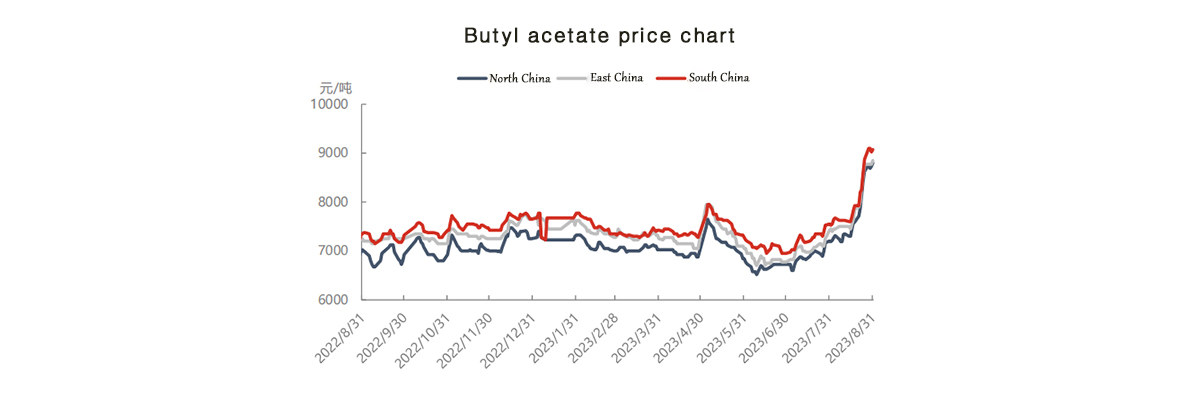

At the beginning of last week, the market price of butyl acetate continued to rise, mainly due to the continuous increase in the market price of raw material n-butanol, the cost was strongly supported by the butyl acetate market, and some factories were forced to stop due to shortage of raw materials. All aspects support the rise of market prices, while the downstream level has a certain resistance to such high prices. Some downstreams have changed their own formulas to seek profits, and the overall market buying momentum is not good. In the later period, as the price of n-butanol stabilized, the market gradually returned to rationality. At this time, the willingness to take profits in the market was obvious, which led to the obvious weakening of the price of downstream goods, and some downstream buyers bought on dips. Towards the end of the week, the market price followed the rise of raw materials, followed by rising again, and the transaction performance weakened. Looking at this week, the high cost is still supporting the absolute price of the market, the demand side is relatively limited in entering the market at high prices, rigid demand procurement is still the mainstream operation in the market, and the fluctuation of supply is relatively small. Pay attention to the dynamics of installations in South China, and the supply and demand are basically maintained status quo. This week, the butyl acetate market may operate strongly, and attention should be paid to the movement of raw materials.

Ethyl acetate shut down in Anhui Huayi plant this week, and the load of Guangxi Xintiande plant fluctuated, and the industry’s capacity utilization rate dropped significantly; as the capacity utilization rate continued to decline, the factory price of ethyl acetate was pushed up, and the overall increase was higher than that of raw materials, so the profit was slightly A little higher, but still on the verge of a loss.

Post time: Sep-04-2023